Sep 7,

2019

Frank

Lee

Image source: FinancialSense.com

“Aftermath” is the latest addition to three previous

publications by Rickards, Currency Wars (2011), The Death of Money (2014), The

Road to Ruin (2016). Together, with the present offering (Aftermath, 2019), the

author uses the analogy of the Four Horsemen of the Apocalypse to illustrate

the themes of his four books. The latest book is thematic in its approach to

the events which have taken place in the world in general and the United States

in particular during this period.

HIGH SOCIETY

Rickards had previously worked for the CIA (possibly

still does – who knows?) but now seems to be a free-wheeling business

executive, writer and strategic analyst. He tends to circulate outside of the

usual middle-ranking semi-elite circles preferring to consort with the less

observable, higher-ranking coteries of the inner-party. Moreover, he has

nothing but disdain for the run-of-the-mill talking heads to be found (in

abundance) in the media and academia – the outer-party.

His observations of this social stratum are

unapologetic and caustic:

History is the first casualty of media micro-second

attention span. An army of pseudo-savants saturate the airways to explain that

tariffs are bad, trade wars hurt growth and mercantilism … are a throwback to

the 17th century. These sentiments come from mainstream liberals and

conservatives and tag-along journalists trained in the orthodoxy of so-called

free-trade and the false if comforting belief that trade deficits are the

flipside of capital surpluses. So, what is the problem? … The problem is that

perpetual trade deficits have put the United States on a path to a crisis of

the US$.”[1]

As is apparent, his contempt is palpable.

It should be said that much of his writing and

theorising is at times occasioned by a high level of sophistication, alas sadly

lacking in most of his contemporaries. But for all his refinement and eloquence

that doesn’t stop him being, from Off Guardian’s perspective (and mine), on the

other side – the side of the Anglo-Zionist empire.

THE GREAT BETRAYAL

Throughout this book and previous books there runs a

familiar leitmotif; a sense of betrayal by the present dominant section of the

US elite. This is not by any means an unusual political phenomenon and bears

comparison with the stab-in-the-back myth – a notion doing the rounds in

Germany circa 1918.

It held that the German Army did not lose World War I

on the battlefield but it was ‘traitors’ on the home front, especially the

traitorous republicans who overthrew the Hohenzollern monarchy in the German

Revolution of 1918–19.

This precedent loosely corresponds to Rickards’ belief

in the perfidy of the current leadership of the US and his vitriol is directed

against this globalist faction who are firmly ensconced in both Democrat and

Republican parties and whom, he argues, have sold the pass in terms of

America’s strategic interests. He writes:

Obama, both Bushes, and Bill Clinton were globalists,

defined as those willing to trade-off or compromise US interests for the sake

of a stronger global community … even conservative hawks like Reagan and JFK

were firmly in the globalist camp, as they relied on NATO, the UN and the IMF …

to pursue their cold war goals.

However, all was not lost. As a result of…

…the Presidential election of 2016 when Donald Trump

was sworn in on 17 January 2017 as the strongest nationalist since Theodore

Roosevelt. For the first time in 100 years a committed nationalist was sitting

in the Oval Office.” [2]

The event was obviously political grist to Rickards’

mill.

However, precisely how this liberation of the US from

the domestic globalists’ stranglehold was to be brought about wasn’t made

clear, and in fact is barely touched upon by Rickards.

Trump, for all his bombast and promises to Make

America Great Again (MAGA), and pursue a radical foreign policy of withdrawal

from globalist wars of choice and military adventurism, has been conspicuous by

its absence.

Moreover, from the outset he has been beset by the

ancien regime of neo-conservatives and neo-liberals – Bolton, Pompeo and Pence

– entrenched in key US institutions, as well as various think-tanks and media

who are still doggedly set upon the realization of neo-con foreign policy

goals.

It seems odd that Rickards doesn’t see fit to comment

on this important development given that Trumps’ campaign promises have

disappeared almost without trace since he entered the Oval Office.

IT’S THE ECONOMY STUPID

Rickards is on firmer ground, however, when dissecting

the 8th wonder of the world – US economic policy. The US sovereign debt (i.e.,

the debt of the Federal Government) to GDP is now at a record, this is unprecedented

for a peacetime administration.

In addition, it is also worth noting the magnitude of

US private debt and unfunded future liabilities, pensions, Medicaid, social

security and so forth.

This would include household debt, student debt,

financial debt, corporate debt, and municipal debt. Add this to sovereign debt

and you get a figure roughly 5 times US sovereign debt, and even this is

regarded as being a conservative figure according to many – see David Stockman,

John Mauldin et al).

According to Rickards, the present situation has been

largely the result of excess spending by both Democratic and Republican

administrations. The spending has either been on ‘Defence’ – a Republican

favourite – or social like L.B. Johnson’s ‘Great Society’ programme – a

Democratic favourite.

LBJ’s administration contrived to conduct the Vietnam

War as well as an expensive social programme, simultaneously. A guns plus

butter economy. (The original version of the Guns versus butter argument was

given in a speech on January 17, 1936, in Nazi Germany. The then Minister of

Propaganda Joseph Goebbels stated: “We can do without butter, but,

despite all our love of peace, not without arms.”)

LBJ’s guns-and-butter policies were enacted in the

late sixties at the height of the Vietnam war and the Tet Offensive. The

utopian attempt to have the best of both worlds brought LBJ’s administration to

an end; more importantly, perhaps it was also the beginning of the process

which brought down the curtain on the post WW2 economic world order established

at the Bretton Woods conference in 1944.

Because the costs of the Vietnam war were superimposed

on the economy not far effectively from full employment, the US domestic sector

was severely destabilised.

Instead of taxing the nation to pay for the war, the

government engaged in the more acceptable practice of deficit financing…

Vietnam showed that neither the United States nor any

other democratic nation can ever again afford the foreign exchange costs of

conventional warfare, although the periphery was still kept in line by American

military initiatives most recently in Yugoslavia and Afghanistan.

The lesson in the long term is that peace will be

maintained only by governments refusing to finance the military and other

excesses of the increasingly indebted imperial power.” [3]

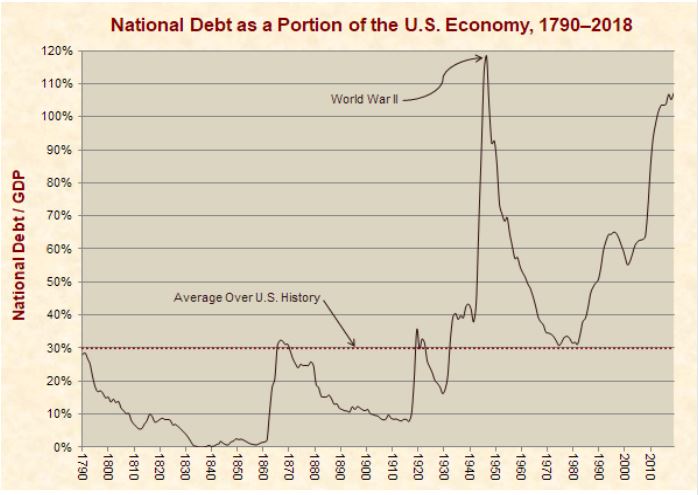

The figure for the US sovereign debt – began to rise

relentlessly from the 1980s onwards approaching wartime levels by the time of

the 2008 blowout.

It has been estimated by some economic theorists that

any sovereign Debt-to-GDP figure greater than 60% represents a tripwire whereby

governments should act to rein in government expenditures.

The EU Maastricht criteria, for example, stipulated

that EU Debt-to-GDP should not go over 60% except in certain circumstances and

an annual budgetary deficit should not be more than 3%.

That is a pretty tight monetary and fiscal policy EU

style, but not to be outdone the spendthrift US was to go on a wild binge in

both fiscal and monetary terms the result of which is a now an unpayable

mountain of debt. This gives an indication of how far US economic policymaking

has drifted away from any viable economic strategy.

Rickards fulminates:

To see how America came to this pretty pass we, one

needs to review almost 40 years of fiscal policy under Presidents Reagan, Bush

1, Clinton, Bush 2, Obama and Trump from the period 1981-2019.” [4]

Under Reagan in 1981 US Debt-to-GDP ratio was 32.5%.

The President was gung-ho for tax cuts and big spending increases, particularly

‘defence’ spending. This trend was continued under the tutelage of the Bushes

and Clinton, and Debt-to-GDP ratio rose to 56.4% when Bush Jr, took office and

had risen to 82% by the time he left.

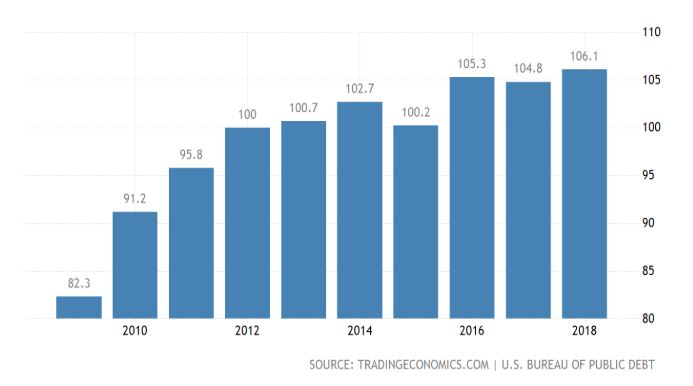

The Obama years saw the Debt-to-GDP rise to 100%. The

diagram below 2009 debt-to-GDP was 82.3% This figure has risen inexorably to

over 100% in 2018. Yep, here we have the dreaded law of Diminishing returns.

Every new dollar of input gives you 90 cents of output.

The above diagram illustrates the growth of debt

vis-à-vis National Income (GDP) since the 2008 blowout. Debt has been growing

progressively faster than National Income.

The US economy, like the US shale oil industry, has

become a Ponzi scheme in all but name. The Fed’s issuance of new debt to pay

off existing debt signals the key moment of the Minsky crisis.[5]

There doesn’t appear to be any viable way out this

predicament short of a straight default. But Rickards argues that ‘the United

States will never default on its debt because the Fed can simply print the

money and to pay it off.’ This will involve an engineered inflation to wipe out

the debt. But in fact, inflation is the default, a default by the back door.

Getting paid in worthless currency is in essence no different than not getting

paid at all.

NO EXIT

As for solutions to a crisis which has seemingly

reached the point of no return, all that Rickards can offer is a Japanese

scenario of low or zero growth punctuated by recession for the United States

and by implication for the rest of the world. The United States had its first

long decade from 2007 to 2017 and is now into its second decade.

This growth pattern will persist absent of

inflationary breakout which the Fed seems powerless to ignite in the short run;

a war; or severe depression perhaps caused by a new financial crisis.[6]

Not much of a prospect for the average family then.

But Rickards does give some useful advice to his more opulent readers on how

they should diversify their assets.

There are apparently “luxury bombproof bunkers

built in former missile silos and expansive estates in New Zealand loaded with

rations and good wines.”

Really? At this point one wonders if Mr Rickards is

being serious or just smug.

SOCIAL IMMOBILITY AND THE RISE OF OLIGARCHY

The social and economic impact on levels of inequality

in both the US and globally have been extremely deleterious and seem set to

continue. Inequality in income and wealth – a phenomenon identified and

outlined by Thomas Piketty – is resulting in societies which more and more

resemble feudal economic and social structures rather than textbook capitalism.

Social class is hardening into social caste and rates of social mobility are

decelerating at an alarming rate.

The liberal notion that the individual is the author

of his/her own destiny has become a very dubious proposition when the

drawbridges of advantage, birth and preferment are drawn up. Moreover, high

levels of income/wealth are not conducive to growth since the new aristocracy

owns most of the wealth/income which is hoarded rather than spent on investment

and/or consumption. Stagnation, idled capital and rent extraction becomes the

economic norm.

Inequality … is common in college admissions where the

wealthy and connected continue to send their sons and daughters to elite

schools while the middle-class are restrained by sky-high tuitions and the

burden of student loans.

It’s true in the housing market where the rich picked

up mansions on the cheap in foreclosure sales whilst the middle-class were frozen

in mortgage negative equity.

It’s true in health care, where the rich could afford

all the insurance they needed while the middle class were handicapped by

unemployment and the loss of job-related benefits. These disparities also

affected the adult children of the middle-class. There are no gold-plated

benefits packages in the gig society …

Research shows that fewer than 50% of all children

aged 30 today earn more than their parents did at the same age. This 50% figure

compares with 60% who earned more in 1971, and 80% who earned more in 1950.

The American dream of each generation earning more

than the prior generation is collapsing before our eyes … The middle class is

getting poorer on a relative basis and lagging further behind the rich whose

incomes absorb an increasing share of total GDP … The manner in which the rich

become rich is variable.

It could be due to a number of unrelated factors …

Problems arise in the way that the rich stay rich become richer and pass on

wealth to their children and grandchildren.” [7]

It is a matter of common knowledge that the

traditional techniques of preserving and creating wealth have been long

established in law, customs, education and socialization; these traditional

methods being practised over decades, if not centuries, have produced a system

of elite self-recruitment, one moreover which endures through time.

Many of the richest US citizens – e.g., Buffet, Bezos,

Zuckerberg – pay minimal tax demands. Much of the wealth of the richest

Americans is never taxed because they hold onto real estate and stocks and pass

them onto their beneficiaries tax-free. This is one of a perfectly legal method

of avoiding tax; there are many more too numerous to cite which include various

other examples of tax avoidance/evasion.

Levels of income and wealth inequality within states

are usually measured by what is called the Gini Co-efficient. This measure is a

commonly used measure of income inequality that condenses the entire income

distribution for a country into a single number between 0 and 1 or 0% to 100%:

the higher the number, the greater the degree of inequality. A rough estimate

of inequality is a figure above 40%.

The United States and China are in the low forties,

surrounded by underdeveloped and developing states such as The Democratic

Republic of the Congo, Uganda, Burundi and El Salvador. At the other end of the

spectrum are Sweden, Norway and Iceland.

In this connection the by now well-known study carried

out by two American academics at Princeton University Prof Martin Gilens and

North western University Prof Benjamin Page argue that the US is dominated by a

rich and powerful elite.

Multivariate analysis indicates that economic elites

and organised groups representing business interests have substantial

independent impacts on US government policy, while average citizens and

mass-based interest groups have little or no independent influence.”

In plain English: the wealthy few move policy, while

the average American has little power.

The two professors came to this conclusion after

reviewing answers to 1,779 survey questions asked between 1981 and 2002 on

public policy issues. They broke the responses down by income level, and then

determined how often certain income levels and organised interest groups saw

their policy preferences enacted.

Americans do enjoy many features central to democratic

governance, such as regular elections, freedom of speech and association and a

widespread (if still contested) franchise. But we believe that if policymaking

is dominated by powerful business organisations and a small number of affluent

Americans, then America’s claims to be a democratic society are seriously

threatened.”

In summation, both gentlemen concluded that in essence

the US was an oligarchy not a properly functioning democracy. All very true but

somewhat self-evident.

Rickards regards the present situation as being

irreversible. He does not present any alternative to this trend other than some

vague hopes that the ‘nationalist’ President in the Oval Office will turn

things around – MAGA in fact.

The golden age of post WW2 capitalism ended when Nixon

took the dollar off the gold standard in August 1971, which was in effect a

default by the US. Holders of surplus dollars in Europe who were no longer able

to swap these dollars for gold but were merely presented with other US$s with

which they had to purchase US Treasurys (Bonds) debts which were never going to

be repaid. In the age of fiat currencies Europe and various other holders of US

Treasuries were in fact subsidizing the United States.

POOR LITTLE AMERICA

At this point the book becomes one long whinge about

how hard done-by America has been and how the rest of the world has taken

advantage of this benign gentle giant. This rather bizarre belief calls for

further analysis. The US pays some of the bill for NATO whilst European nations

pay insufficient amounts for the ‘defence’ of their countries.

It should be pointed out, however, that in terms of

military hardware the NATO alliance is standardized to American specifications.

This means large-scale purchasing of US war materiel which is a gift bonus to

the US armaments industry.

Then Germany has the nerve to buy Russian gas

transported to Europe via Nordstream 2 which is cheaper and more reliable than

US Liquified Natural Gas (LNG), when in fact they should be buying more

expensive and less reliable US LNG. Apparently, Germany ought really to be

subsidising the US shale oil Ponzi racket. Bad, ungrateful Germany.

Then comes the incessant carping regarding trade

policy and trade deals. The US in its speed to become a cool, post-modern,

financialized economy apparently forgot about the importance of production. In

the automobile industry the once dominant US triad of General Motors, Ford and

Chrysler are no longer in the vanguard and Japan, with South Korea catching up,

is now the leading country in the export of auto vehicles, a position which the

US once held. It was the Japanese auto industry which pioneered production

methods including just-in-time deliveries and lean production (Toyota). Was

anyone stopping the Americans from innovating?

In rank order. Figures quoted in Global Shift – Peter

Dicken.

- Volkswagen, Germany: Annual Output

8,576,94

- Toyota, Japan: Annual Output 8,381.968

- Hyundai,

South Korea: Annual Output 6,761,074

- General Motor, USA: Annual Output 6,608,567

- Honda, Japan: Annual Output 4,078,376

- Nissan, Japan: Annual Output 3,830,954

- Ford, USA: Annual Output 3,123,340

- PSA, France: Annual Output 2,554,059

- Suzuki, Japan: Annual Output 2,483,721

- Renault, France: Annual Output 2,302,769

Globally, the leading manufacturer of auto-vehicles is

Volkswagen followed by Toyota. GM are 4th and Ford are 8th of ten. Hardly

market leaders anymore, but Rickards apportions the blame to ‘unfair practices’

by foreign manufacturers and argues instead for tariffs. The same goes for

other trade partners. Fact that the United States has to a large extent been

deindustrialised was a political choice of its own making.

If the US has lost ground in the competition for trade

on world markets that is because of its own insular provincialism and hubris,

not foreign competitive malpractice. Moreover, much of its productive industry

which remains has been outsourced to low cost venues such as China. The US more

than anyone should know that its competitors are simply using the same policies

that it itself used during the 19th century to break British trade hegemony.

It has been the same story with agriculture. Trade

liberalization (this must rank as the greatest misnomer of trade theory) and

trade treaties have been an example of the blatant unfairness of such

agreements. During the Uruguay round of ‘talks’ (1982-2000):

…the United States pushed other countries to open up

their markets to areas of ‘our’ (i.e. the US’s) strength, but resisted,

successfully so, to efforts to make us reciprocate.

Construction and maritime services, the areas of

advantage of many developing countries were not included in the new agreement.

Worse still, financial services liberalization was arguably even harmful to

some developing countries: as large international (read American) banks

squelched local competitors denying them the funds they garnered would be

channelled to the international firms with which they felt comfortable, not the

small and medium-sized local firms …

As foreign banks took over the banking systems of like

Argentina and Mexico worries about small and medium sized firms within these

countries being starved of funds have been repeatedly voiced.

Whether these concerns are valid or not, whether they

are exaggerated or not, is not the issue: the issue is that countries should

have the right to make these decisions themselves, as the United States did in

its own country during its formative years; but under the new international

rules that America had pushed, countries were being deprived of that right.

Suffice it to say that agriculture has always been a

flagrant example of the double standards inherent in the US trade

liberalization agenda. Although we insisted that other countries reduce their

barriers to our products and eliminate the subsidies for which those products

competed against ours, the United States kept barriers for the goods produced

by the developing countries, and the US continued massive subsidies to its own

produce. [8]

EXORBITANT PRIVILEGE

Oh, I almost forgot: the imperial tribute that the

world pays to the hegemon; aka the reserve status of the dollar. The role of

the US dollar in the world’s political economy gives it advantages which the

rest of the dollar surplus-states are dragooned into accepting. In the late

sixties early seventies, the US was on the verge of technical bankruptcy due to

its spending profligacy at home and military adventurism in Indochina. It had

three choices of how to deal with this acute problem.

[The] 3 courses open to the US government on the

collapse of the Gold Pool in London in 1968 were: immediately pull out of the

war in South-East Asia and cut back overseas and domestic military expenditure

to allow the dollar to firm again on world markets; to continue the war paying

for its foreign exchange costs with further outflows of Fort Knox gold; or to

induce the Europeans and other payments surplus areas to continue to accumulate

surplus dollars and dollar equivalents (US Treasuries) not convertible into

gold.” [9]

Of course, it was option three that appealed and Nixon

in his television broadcast was to announce a ‘temporary’ suspension of gold

sales by the US to its overseas ‘partners’.

The date in question, 15 August 1971, marked the end

of one epoch and the beginning of another. The temporary suspension soon

morphed into a permanent one and a global fiat currency regime based on the

dollar came into being. This represented a culmination of a situation in which

the US manipulation of the dollar was termed the ‘Exorbitant Privilege’ by the

senior French politician Valery Giscard d’Estaing. And privilege it was.

The central political fact is that the dollar standard

places the direction of the world monetary policy in the hands of a single

country which thereby acquires great influence over the economic destiny of

others. It is one thing to sacrifice sovereignty in the interests of

interdependence; it is quite another when the relationship is one-way.

The difference is that between the EEC(EU) and a

colonial empire. The brute fact is that the acceptance of a dollar standard

necessarily implies a degree of asymmetry in power which, although it actually

existed in the early post-war years, had vanished by the time that the world

sliding into a reluctant dollar standard.” [10]

There were a number of advantages which accrued to the

dollar contingent on the ending of gold convertibility which Eichengreen listed

these in his book. But the principle one was making the surplus nations of the

world pay for America’s wars with an unconvertible currency. Instead of being

paid for in gold, or at least a gold-backed currency the world produced goods

and services for a piece of green paper backed by nothing.

Quite a clever little racket when you think about it.

Better still is the way that the two biggest surplus

nations, Japan and China, have been the US’s main creditors, bankrolling the US

by buying its Treasuries. This had another intended, or perhaps unintended

effect: long term interest rates on US bonds came down (since bond prices and

bond interest rates move in opposite directions) and enabled the property

bubble to expand until the inevitable blow-out in 2008.

In mafia terms the US dollar has been a ‘made’

currency enjoying a set of privileges and protection which it did not earn but

foisted upon others. This is a unique dispensation which is enjoyed by the US

to which the rest of the world is excluded.

However, it is in the nature of things that privileges

will ultimately get abused. In pushing its luck to the point of abuse the US

should be aware that initial signs are that the world is sloughing off the US

dollar. As it proceeds in that direction, the US currency will lose its

position as the global reserve asset. Holders of trillions of

dollar-denominated assets will become sellers eventuating in a collapse of the

currency.

The US economy lives like a parasite off its partners

in the global system, with virtually no savings of its own. The World produces

whilst North America consumes. The advantage of the US is that of a predator

whose advantage is covered, by what others agree, or are forced, to contribute.

Washington uses various means to make up for its

deficiencies: for example, repeated violations of the principles of liberalism,

arms exports, and the hunting-down of oil super-profits (which involves the

periodic felling of producers; one of the real motives behind the wars in Iraq

and Central Asia).

But the fact is that the bulk of the American deficit

is covered by capital inputs from Europe and Japan, China and the South, rich

oil-producing countries and comprador classes from all regions, including the

poorest, in the third world, to which should be added the debt-service levy

that is imposed on nearly every country in the periphery of the global system.

The US superpower depends from day to day on the flow of capital which sustains

its economy and society. The vulnerability of the United States represents a

serious danger to Washington’s project.” [11]

In light of the above we may conclude that – in spite

of the irritating name-dropping – Rickards’ books are interesting well written

and well-argued; per contra they are very light on facts which have been left

deliberately unexamined as well as counter-narratives which have also been

ignored.

This was to be expected quite simply because at bottom

Rickards is a sophist much in the tradition of Protagoras, Gorgias and

Thrasymachus “I say that justice is nothing other than the advantage of

the stronger” [12]

A view which Rickards would certainly endorse. Beneath

the Upper Manhattan, polished chic, there resides a ruthless Cold Warrior. The

further one digs into the book, the more this becomes apparent.

NOTES:-

[1] Rickards – Aftermath – page.21

[2] Ibid., – page.65

[3] Michael Hudson – Super Imperialism – pp.298/99,

32.

[4] Rickards – Ibid. – page.66

[5] Hyman Minsky’s theories about debt accumulation

received revived attention in the media during the subprime mortgage crisis of

the late 2000s. The New Yorker has labelled it “the Minsky Moment”. Minsky

argued that a key mechanism that pushes an economy towards a crisis is the

accumulation of debt by the non-government sector. He identified three types of

borrowers that contribute to the accumulation of insolvent debt: hedge

borrowers, speculative borrowers, and Ponzi borrowers.

The “hedge borrower” can make debt payments (covering

interest and principal) from current cash flows from investments. For the

“speculative borrower”, the cash flow from investments can service the debt,

i.e., cover the interest due, but the borrower must regularly roll over, or

re-borrow, the principal. The “Ponzi borrower” (named for Charles Ponzi, see

also Ponzi scheme) borrows based on the belief that the appreciation of the

value of the asset will be sufficient to refinance the debt but could not make

sufficient payments on interest or principal with the cash flow from

investments; only the appreciating asset value can keep the Ponzi borrower

afloat.

[6] Rickards – Ibid., page.85

[7] Rickards – Ibid., page.239

[8] Joseph Stiglitz – The Roaring 90s – pp.206/207

[9] Gold Pool 1968. The price of one troy ounce of

gold was pegged to US$35. … The larger the gap, known as the gold window,

between free market gold price and the foreign exchange rate, the more tempting

it was for nations to deal with internal economic crises by buying gold at the

Bretton Woods price and selling it in the gold markets. It

couldn’t last and it didn’t.

[10] Michael Hudson – Ibid. – p.309

[11] Barry Eichengreen – Exorbitant Privilege –

passim.

[12]

Plato – The Republic.

00

Frank Lee left school at age 15 without any

qualifications, but gained degrees from both New College Oxford and the London

School of Economics (it's a long story). He spent many years as a lecturer in

politics and economics, and in the Civil Service, before retirement. He lives

in Sutton with his wife and little dog.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.